Key Takeaways

Identify Assets: Inventory all tangible, financial, and digital assets, plus liabilities.

Choose Beneficiaries: Decide who inherits your assets, including family, friends, and charities.

Select an Executor: Choose a trustworthy and organized individual to execute your will.

Consider Guardianship: Appoint a guardian for minors, ensuring alignment with your values.

Witness Requirements: Ensure proper witnessing as per state laws to validate your will.

Regular Updates: Adjust your will for life changes and asset fluctuations to keep it current.

Digital Assets: Include plans for managing online accounts and digital properties.

Debt and Tax Clarity: Provide clear instructions on debt settlement and understand tax impacts.

Pet Care: Make arrangements for pet care and associated finances.

Crafting a will is an essential step in securing the future of your loved ones. It transcends simply dividing possessions; it offers a powerful tool to minimize confusion, emotional burdens, and potential legal challenges for your beneficiaries. An online will streamlines this process, enabling you to create a legally sound document from the comfort of your home, saving you valuable time and potentially reducing costs.

Read on to explore the components of a comprehensive online will and ensure your wishes are effectively communicated for the benefit of those you hold dear.

Identify Your Assets

Before outlining your wishes in a will, taking stock of everything you own that holds value is essential. This comprehensive list, called an inventory, ensures clarity and avoids confusion about how you want your assets distributed.

Here’s a breakdown of what to include:

Tangible property

This encompasses real estate you own (house, condo, land), vehicles (cars, boats, motorcycles), and any household possessions with value (jewelry, furniture, artwork, electronics). Consider the sentimental value of these items in addition to their market value.

Financial assets

Include all your bank accounts (checking, savings, investment), retirement accounts (IRAs, 401(k)s), stocks, bonds, and any other investments you hold.

Debts and liabilities

While not technically an asset, listing your outstanding debts (mortgages, car loans, credit card balances) provides a complete picture of your financial standing. This helps your executor determine the net value of your estate.

A thorough inventory empowers you to make informed decisions about distributing your assets and minimizes potential disputes among beneficiaries.

Choose Your Beneficiaries

Your will allows you to designate beneficiaries—the individuals or organizations who will inherit your assets after you’re gone. This decision is deeply personal, and no single ‘right’ answer exists.

Here are some considerations when selecting your beneficiaries:

Family and loved ones

Spouses, children, parents, siblings, and other close relatives are often the primary beneficiaries. You can distribute your estate equally or designate specific percentages for each person.

Friends and charities

Close friends who have been there for you or charities you care about can also be included in your will. Consider a specific donation amount or a percentage of your remaining estate.

Conditional inheritances

You can set conditions for receiving an inheritance. For example, you might require a beneficiary to reach a certain age or complete their education before accessing their inheritance.

Trusts

A trust allows you to manage how your assets are distributed. You can create a trust for a minor child, a pet, or a specific purpose, ensuring the assets are used as intended.

Carefully consider who you want to inherit your assets and how you want them distributed. This thoughtful planning can ensure your legacy is passed on according to your wishes.

Select an Executor

Ensuring your wishes are carried out after you’re gone requires a reliable individual—your executor. This person manages your estate according to your will’s instructions.

Here are some considerations when choosing your executor:

Trustworthiness and reliability

Select someone you trust implicitly to handle your financial affairs with honesty and integrity. Their dependability ensures your wishes are fulfilled accurately.

Financial acumen

While in-depth financial expertise isn’t mandatory, some comfort with managing finances is helpful. They should be capable of overseeing asset gathering, debt settlement, and estate distribution.

Organization and communication skills

Strong organizational skills keep them on track during the probate process. Effective communication keeps your beneficiaries informed throughout the process.

Willingness to serve

Discuss the role and responsibilities with your chosen executor beforehand. Ensure they understand the commitment and are willing to take on this task.

Choosing the right executor is crucial in ensuring a smooth and efficient administration of your estate.

Consider Guardianship

If you have minor children, your will offers a powerful tool to ensure their well-being in the event you and your spouse are no longer alive. By appointing a guardian, you designate a trusted individual who will assume legal responsibility for your children’s care.

Here are some factors to consider when making this critical decision:

Choosing the right caregiver

This is undoubtedly the most critical step. Select someone who loves your children unconditionally, shares your values regarding their upbringing, and possesses the emotional and financial stability to provide a secure and nurturing home.

Discussing your wishes

Open communication is essential. Talk to your preferred guardian about your expectations and wishes for your children’s care. This conversation allows them to understand your priorities and assess their ability to fulfill this responsibility.

Considering a backup plan

Life can be unpredictable. Having a contingent guardian named in your will ensures there’s a trusted alternative if your primary choice is unable or unwilling to serve.

Selecting a responsible guardian provides peace of mind, as you know your children will be cared for by someone you trust to act in their best interests.

Witness Requirements

To ensure your will is legally enforceable, most states require it to be witnessed by a few disinterested individuals.

Here’s a breakdown of essential points to remember:

Number of witnesses

The number of witnesses required varies by state. In most states, two witnesses are sufficient, but some may require three. Research your state’s specific requirements to ensure compliance.

Witness eligibility

The individuals witnessing your will cannot be beneficiaries named in the document or your spouse. This prevents any potential conflicts of interest. They should be impartial adults of sound mind.

Witness signature and availability

The witnesses must sign your will in your presence and in the presence of each other. Having them print their names and addresses beneath their signatures is also advisable for better record-keeping. Ideally, choose witnesses who are likely to be around in case their presence is needed during probate.

Following these guidelines helps guarantee your will’s validity and ensures your wishes are carried out as intended.

Review and Update

Life is dynamic, and your will should reflect that.

Here’s why regular review and updates are essential:

Life changes

Marriage, birth of children, or changes in relationships with beneficiaries may necessitate modifications to your will. You may want to add new beneficiaries or adjust inheritance percentages.

Asset fluctuations

The value and type of assets you own can change over time. Reviewing your will ensures your bequests remain accurate and reflect your current wishes.

Executor availability

Your chosen executor’s circumstances may change. If they’re no longer willing or able to serve, you’ll need to appoint a new one.

By scheduling regular reviews and updating your will as needed, you guarantee your estate is distributed according to your latest intentions. This provides peace of mind, knowing your loved ones will be cared for as you desire.

Consider Digital Assets

The digital age has introduced a new category of assets to consider for your will.

Here’s what you need to know:

Identifying digital assets

This includes online accounts (social media, email), digital documents (financial records, photos), and cryptocurrency holdings. Inventory these assets and determine how you want them managed or distributed after your passing.

Account access instructions

Consider including instructions for accessing your digital accounts. This could involve providing login credentials to a trusted individual or outlining a process for them to obtain access from the service providers.

Data ownership and legacy

Think about how you want your digital legacy handled. Do you want certain accounts deactivated? Photos preserved and shared? Specifying your wishes regarding your digital footprint helps ensure your online presence is managed according to your preferences.

By addressing digital assets in your will, you ensure these increasingly valuable components of your estate are handled appropriately.

Clarify Debts and Taxes

Your will can help minimize confusion and disputes regarding your estate’s financial obligations.

Here’s what to consider:

Specifying debt repayment

Outline how you want your outstanding debts to be handled. Will they be paid from your estate before distributing assets to beneficiaries? Specifying your wishes avoids placing this burden on your loved ones during an already difficult time.

Tax implications

Be aware that inheritance may be subject to taxes. While you cannot control these taxes through your will, consulting with a financial advisor can help you develop strategies to minimize the tax burden on your beneficiaries.

Addressing these financial considerations in your will promotes clarity and ensures your estate is distributed efficiently.

Provide for Furry Family Members

For many, pets are cherished companions. Your will can provide peace of mind regarding their future care.

Here are some options to consider:

Pet guardianship

Designate a trusted individual to care for your pet after you’re gone. This could be a friend, family member, or professional pet caregiver. Discuss your wishes with your chosen guardian and ensure they’re willing and able to take on this responsibility.

Financial allocation

Consider setting aside funds to cover your pet’s future care, including food, veterinary bills, and pet-sitting services. This allocation can be placed in a trust designated explicitly for your pet.

Including your pet in your estate planning demonstrates your compassion and ensures their well-being is looked after.

Conclusion

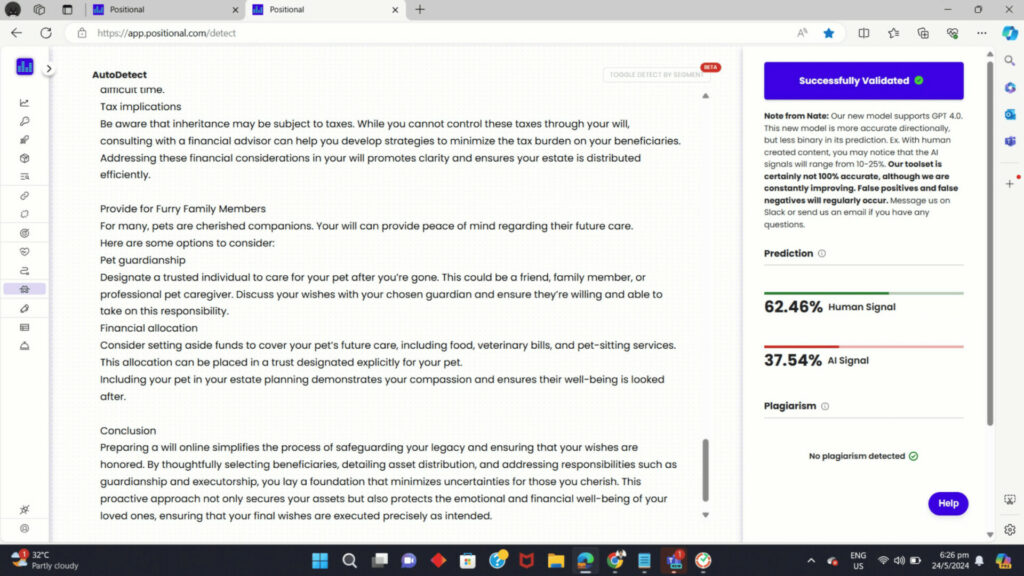

Preparing a will online simplifies the process of safeguarding your legacy and ensuring that your wishes are honored. By thoughtfully selecting beneficiaries, detailing asset distribution, and addressing responsibilities such as guardianship and executorship, you lay a foundation that minimizes uncertainties for those you cherish. This proactive approach not only secures your assets but also protects the emotional and financial well-being of your loved ones, ensuring that your final wishes are executed precisely as intended.

Want More?

We hope you’re enjoying our content. For a deep dive into all things related to Habit, click here! For more helpful advice on a range of topics, explore our Success Blog now!